Why and How Consumer Brands Should Track Repeat Rates

Okay, let’s talk repeat purchase. If you’re a consumer brand entrepreneur that sells online (partially or 100%) and we’ve talked about your business, I probably asked about your repeat rates within the first 30 minutes of our conversation. I probably wanted to ask in the first 5 minutes because for any consumer brand that sells through e-commerce my belief is that repeat purchase rate is one of, if not the most important metric you can track in evaluating the health, value and potential of your business.

In light of that, when I speak with entrepreneurs I’m commonly struck by two things: first, not everyone seems to care about repeat rates as much as I do; and second, every time I ask the question I hear a different method of measuring repeat purchase. I want to try to clear things up by explaining why I care so much about repeat rates at all, and then how I think they should be measured.

Why Repeat Rates Matter

There are plenty of reasons why repeat rates are useful and important, but I think those most telling connect directly to company valuation: businesses with higher repeat rates are, all else equal, higher quality and more valuable businesses. These five reasons are top of mind for me.

It’s cheaper to keep an existing customer than to acquire a new customer.

I start with this fact because many have heard it before. Acquiring a customer is at least five times more expensive than retaining a customer, so in any cash-strapped emerging consumer brand there are few better ways to reduce burn and drive capital efficiency than to improve your repeat rates. Capital efficient businesses are more valuable.

It’s easier to grow a business when customers come back.

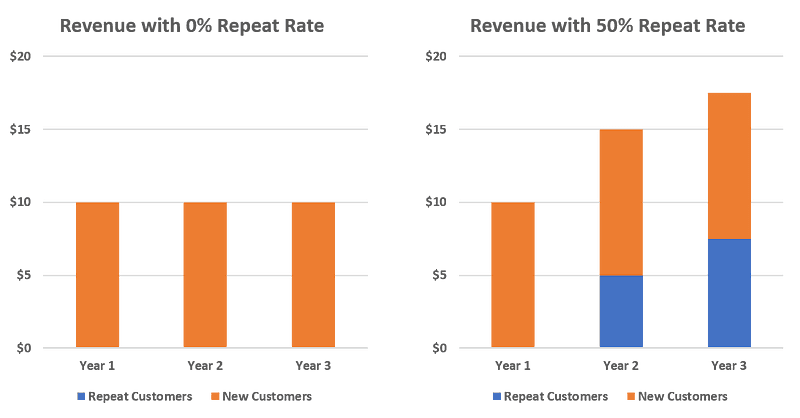

This is particularly important for venture capital-backed brands who must hit a certain growth rate each year to keep their existing investors happy and engaged and attract new investors for subsequent rounds. If you posted $10 million of revenue last year and need to post $20 million this year, without repeat purchase from existing customers you are effectively starting from scratch and have to convert twice as many people as you did last year — this is a common problem for DTC brands selling durables like mattresses or suitcases. On the other extreme, if every single one of last year’s customers ordered the same quantity this year you would only need to find $10 million of new revenue — you would be halfway to your goal already. Think of repeat customers as not just cheaper, but as a head start on growing fast — the effect is especially clear in the chart below. Fast growing businesses are more valuable.

Intuitively, repeat business can create meaningful growth without needing to increase customer acquisition

Repeat purchase is more predictable.

One thing I love about consumer brands is the way they can become absolute mainstays in your daily life. Whether it’s my morning coffee at Starbucks or my Saturday lunches from Urban Remedy, my friends and family can attest to the consistency of my routine and how lucrative it is for the brands that have “acquired” me. That’s because when it comes to those choices I don’t even think — the purchase is so automatic that to the brands themselves, the money I spend is highly predictable. Predictable revenue can be more accurately budgeted and results in less of the volatility that scares off investors. Consumers that repeatedly buy your products are the closest you can get to contracted revenue in the world of CPG, and there is a reason that companies with contracted revenue trade at higher multiples. Predictable businesses are more valuable.

Repeat rates are a key component of return on investment.

For emerging consumer brands that outsource their production and mainly invest their resources into product development and marketing, Lifetime Value to Customer Acquisition Cost (LTV/CAC) is the best metric to measure Return on Invested Capital (ROIC). Many investors see ROIC as the most important metric in evaluating a business at it correlates most closely with company value. To raise LTV/CAC a CEO really only has four levers to pull: lower CAC, raise Average Order Value (AOV), increase Gross Margin, and improve repeat purchase. Repeat rates are a critical piece of the ROIC equation for a consumer brand. High ROIC businesses are more valuable.

Repeat rates are a signal of consumer value proposition.

We as investors typically get most excited about brands that uniquely make a consumer’s life better. Maybe that’s saving time in their day, making a treat they’ve always loved much healthier, or converting a painful purchase occasion to something more affordable and enjoyable — in any case, we believe in brands that offer a strong consumer value proposition. There are a number of ways to imperfectly measure the value proposition, like how many friends does a customer refer to the brand, or what ratio of website visitors convert to customers, but the simplest one is often the repeat rate. If your product is so great then your consumers should want to buy it again. Businesses with a strong consumer value proposition are more valuable.

So Repeat Rates Matter… How Should We Measure Them?

I promise that I’m not trying to be dramatic when I say that the way we measure repeat purchase is critical. There are many ways to measure repeat rates, but most are clouded by other aspects like growth rate and age of the business. Here are some of the ways I’ve heard an entrepreneur tell me their repeat rate is 30% (made up number) and what might be misleading about them:

Method 1: 30% of orders this month came from repeat customers

This decreases if the company accelerates in adding new customers, and increases as the company gets older with a larger pool of customers having time to repeat. Neither of these factors relate to a consumer’s likelihood of repeat purchase.

Method 2: 30% of sales this month came from repeat customers

Same factors impact this metric as #1, but with the added effect of consumer spend. If repeat customers spend more or less than first time customers, the metric will move up or down, respectively.

Method 3: The average customer has ordered three times

I don’t know whether you have a small group of enthusiasts who have bought your product ten times and a large group that don’t repeat, or if every customer repeats and has bought three so far.

Method 4: 30% of the entire customer base has ordered at least twice BUT most of my customers haven’t been around long enough to repeat (because I’m growing so fast) so the real number is actually higher

I get this one a lot. This one is problematic not because it’s not true (it often is!) but because it’s easily solvable by resisting the temptation to look at your consumer base in one big bucket rather than in cohorts. Investors love cohorts for two reasons. First, customers who first purchased at the same point in time tend to behave similarly; think of subscriptions — many people cancel one month or twelve months after signing up, not necessarily because it’s July. Second, the brand itself may evolve over time which can impact repeat rates; think of reformulation or re-branding — if a product actually tastes or looks better at a certain point in time, the consumer who tries it then for the first time is more likely to purchase again. The solution to the problem above is to only look at cohorts that first purchased long enough ago that they have had time to buy the product again.

Method 5: 30% of customers that first ordered at least 12 months ago have ordered more than once

This is method of measuring repeat purchase that makes the most sense to me: if a new customer orders, how likely are they to order again once they have had long enough to do so? The length of time depends on the product. Toothpaste? Maybe three months. Socks? Possibly closer to a year. There is no right answer here but it has to make logical sense.

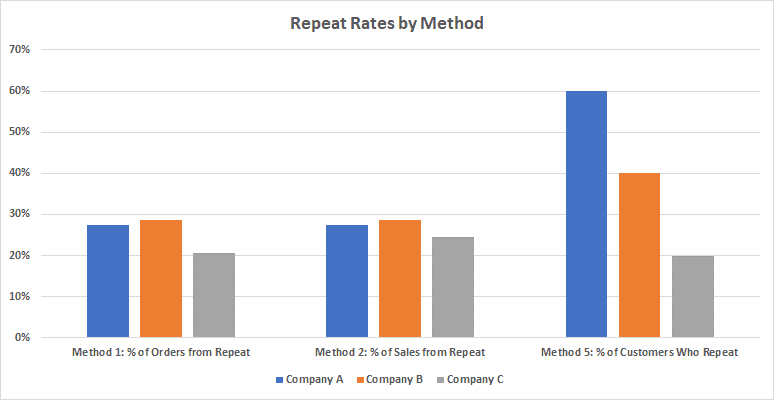

The crazy thing is the way these methods can tell such varying stories. See below for how three different companies can look quite similar in method 1 or 2, and quite differently using method 5. Fast growth and company maturity can really cloud the benchmarks when using the wrong method.

Company A’s consumers repeat 3x as frequently as Company C’s, but not every method tells that story

So Why Does This Have to be So Hard?

If you’re the CEO of a consumer brand I feel your pain in trying to track this metric accurately. Not only do you have Shopify’s template reports using different methods that may not fit your needs, but then you also have to deal with omni-channel attribution! What do you do about a customer you acquire with your website who re-orders on Amazon and then picks your product up at Target on their drive home?

There will always be an art to this science. My point is not that this has an easy solution, but that it’s a problem worth spending the time on to get right. For something so impactful on company valuation, you should have a number on your CEO dashboard that is front and center telling you the clearest possible story.

If it’s helpful I’ve included the spreadsheet backup HERE to the chart above. Copy-paste into excel, play with it yourself and let me know what you think.

SHARE