The U.S. healthcare system is massive– nearly $5 trillion annually, close to 20% of GDP. Yet outcomes remain among the worst in the developed world. Chronic disease drives 90% of costs, life expectancy is declining, and most consumers report dissatisfaction with their care.

At the same time, discretionary spending on consumer wellness is exploding. According to the 2025 Forerunner Consumer Trend Report, more than 65% of people now rank health and wellness as their top life priority– outranking career, family, and entertainment– while consumer-directed wellness spending already represents $1.8 trillion annually and is growing 6-15x times faster than GDP in many categories.

This trend reflects a profound cultural shift– health is no longer just about treating illness, but about actively managing performance, longevity, and quality of life.

Two Forces Reshaping the Ecosystem

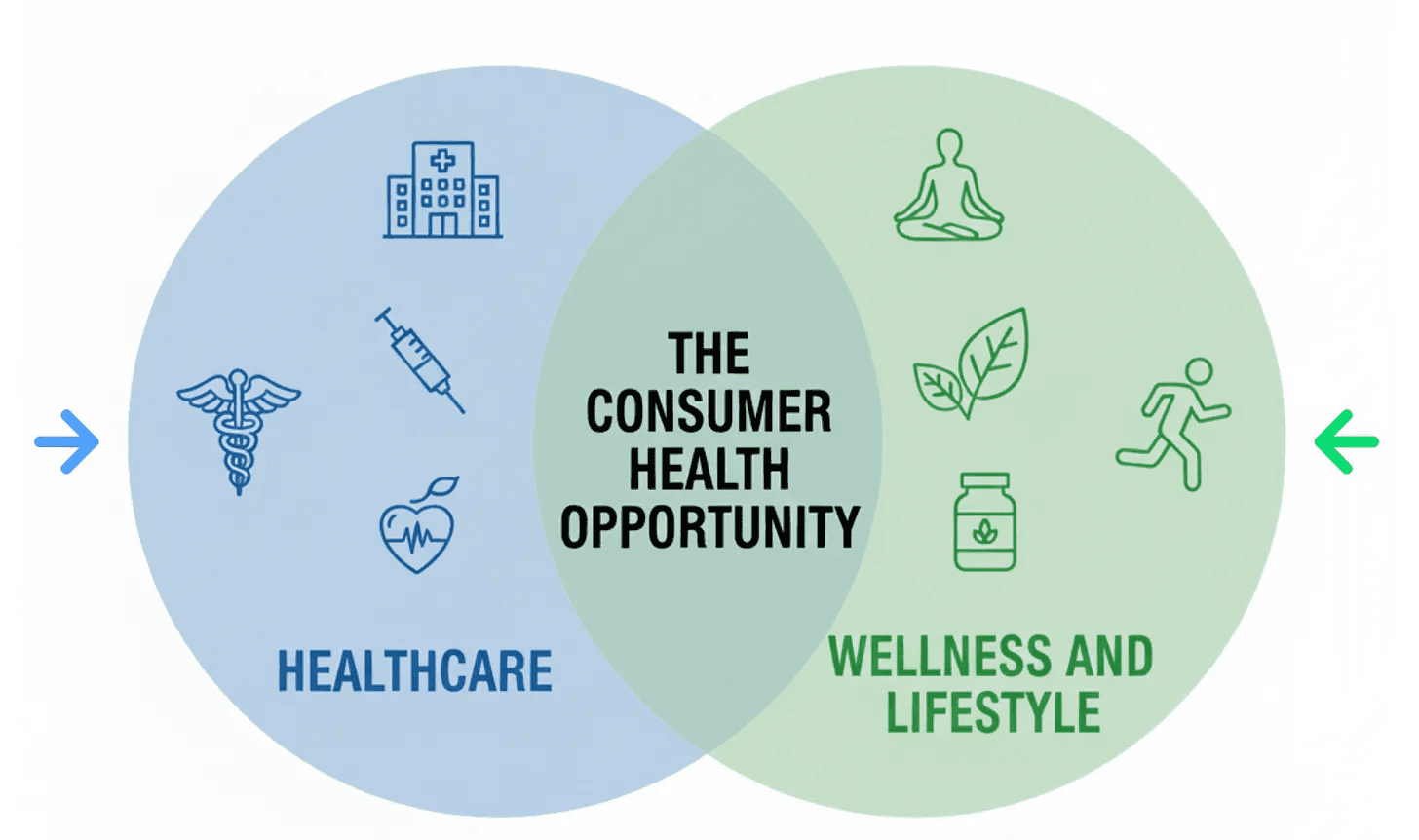

At the intersection of these two markets– healthcare and wellness– is what I would define as the consumer health opportunity, which is being rapidly reshaped by two paradigm shifts.

First, healthcare itself is becoming consumerized.

Traditionally, patients were passive participants. Now they’re becoming active shoppers with real choice. Their expectations increasingly mirror other industries: they want transparency, trust, and high-quality experiences on demand.

Second, the boundaries between healthcare, wellness, and lifestyle are collapsing.

What used to be siloed into separate domains is merging into a single, continuous health journey. Drugs like GLP-1s are a perfect example—clinical therapies accessed through both insurers and DTC platforms, with downstream ripple effects across nutrition, fitness, and mental health. Wearables like Oura and Whoop tell a similar story, blurring lifestyle tracking with medical-grade data.

The Value Shift

This convergence is reshaping opportunities in consumer health. Historically, value accrued upstream to incumbents– insurers, pharmacy benefit managers, hospitals, pharma– that managed risk and controlled the system’s scarcest resources:

Access: which doctors are in network, what drugs are covered, etc.

Information: data lives in electronic health records, claims systems, and medical records, largely inaccessible to patients

By controlling these resources, incumbents captured value through gatekeeping, vertical integration, opacity, and lock in. However, that logic is beginning to break down as traditionally scarce resources are being democratized– telehealth has increased access, DTC diagnostics and wearables are putting data in the consumer’s hands, and AI provides access to health information. The truly scarce resources are becoming consumer trust, data, engagement, and outcomes.

At the same time, financial risk has shifted toward consumers– through higher premiums, high-deductible health plans, and out-of-pocket wellness spending. And new payment models are pushing healthcare providers and digital health companies to take on risk tied directly to patient outcomes.

The result is a clear shift downstream, closer to the consumer. That value is concentrating in consumer-facing platforms that win trust, centralize health data, and manage risk by delivering better outcomes.

Platform Models

The word “platform” is intentional here. Traditional healthcare has been structurally misaligned with platform models– consumers lack choice, supply is locked into institutional networks, and data is siloed. Those conditions are changing in the new consumer health economy:

More consumer choice creates opportunities to aggregate services and reduce search costs, as does the fragmentation across clinical, wellness, and lifestyle services

The shift from episodic to continuous care creates engagement loops and persistent data flows (think: ongoing monitoring vs. occasional doctor visits)

Network effects can be much stronger. Health is becoming social (think Oura Circles, Whoop Teams, sharing biological age scores), personalization improves with scale, and ecosystems of compliments– from supplements to fitness to nutrition—are becoming increasingly interconnected

At the same time, structural incentives and inertia make it unlikely that legacy players can lead the consumer health transition. In other words, United Healthcare will never be a consumer-first company.

Meanwhile, barriers to entry are falling quickly as consumer health infrastructure matures. Just as Stripe and Shopify made it easy to launch new consumer brands, a new layer of health infrastructure is now doing the same for healthcare startups by simplifying the backend– connecting to electronic health records, managing pharmacy and diagnostic services, handling insurance contracts, building provider networks, and providing AI for data interpretation. As a result, startups can now bring consumer health products to market faster and at lower cost than ever before.

Why Now?

Several forces are converging to accelerate this opportunity:

Technology has leapt forward. Covid was a forcing function for telehealth adoption, wearables are becoming ubiquitous, diagnostic costs are plummeting, and AI enables personalization at scale

The culture has shifted. Health has become aspirational, social, and destigmatized—people post their sleep scores and supplement stacks on social media, while influencers like Peter Attia and Andrew Huberman mainstream prevention and optimization.

Trust and information flows have been reshaped. Health data lives with consumers, not institutions, and the brands consumers trust most are often creators, communities, or digital platforms—not insurers or hospitals.

Policy is moving in the right direction. New interoperability rules force data sharing. Telehealth reimbursement has become permanent. Value-based care incentives reward better outcomes.

Taken together, these shifts open up a new generation of investing opportunities. I see some of the most exciting opportunities in:

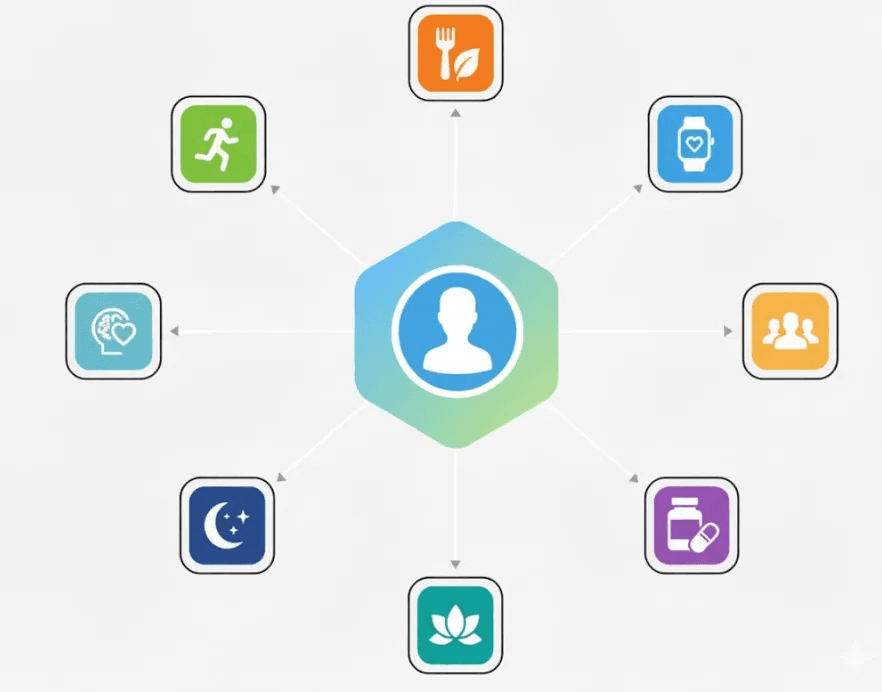

Platforms centralizing the consumer health journey (e.g. the personal health “OS”): Centralize the health journey by integrating fragmented data, surfacing insights, and guiding consumers across prevention, performance, and care.

Preventive and functional medicine: Moving beyond concierge clinics to scalable, affordable models for mass adoption. Concierge clinics traditionally cost $15k+ per year, Function Health is $500

Vertically-focused providers in underserved verticals (e.g. fertility, menopause, mental health, weight loss, etc.): Addressing deep, narrow problems in traditionally high-friction and emotionally-salient categories gives brands the credibility to solve other problems for that consumer.

Wearables as “picks and shovels”: Devices like Oura and Whoop create continuous data streams that enable personalization and new care models

SHARE